What is bills of material (BOM) ?

The bills of material is a particular list of all heads that have been used for making a end product for the users. This may include components, raw material and goods etc. The elements of a final product and cost incurred on making may called as bill of materials. There are various types of expenses and cost which is usually paid on complete production of a product afterwards it send for sale. These all expenses, components, cost etc. must be recorded.

Let's understand with example and by using telly ERP 9:

Bills of material example:

ISD company purchase following material or components from xyz ltd for production of CPU units:

Additional cost including:

Labor charges 600.

The company sold CPU to a debtor after making the final product. Pass the necessary entries.

Solution:

Step by step process for bills of material:

Step 1: create a new company or choose your existing company (alt + F3).

Step 2: Press F11 for company features select inventory features:

Enable stock categories.

Enable multiple go-down.

Step 3: Press f12 select acc/inventory info then.

Step 4: Back to gateway of telly --> accounts info. --> ledgers --> create:

Bank a/c. Under. Bank accounts

Labour charges. Under. Indirect expenses

Creditors. Under. Sundry creditors

Debtors. Under. Sundry debtors

Purchase a/c. Under. Purchase account

Sales a/c. Under. Sales account

Step 5: Back to gateway of telly --> inventory info. --> create:

Stock group. Electronics

Stock categories. Hp, intell etc.

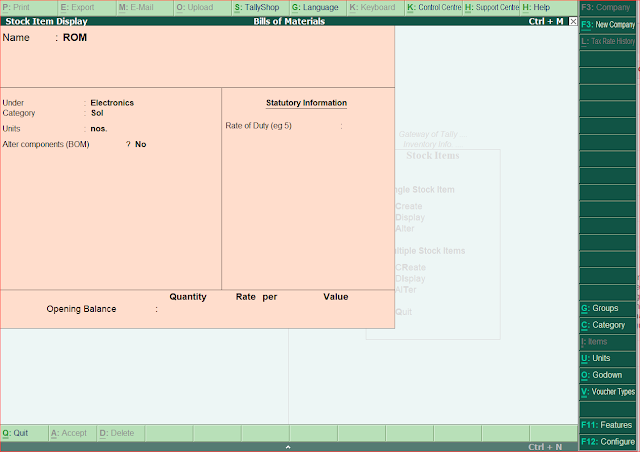

Stock item RAM, ROM, SMPS, processor

Hard disk, mother board.

Units of measure. numbers.

Godown. SD parks.

Step 6: Then back to gateway choose inventory voucher then pass entries:

Press f9 for purchase voucher.

Press f5 for payment voucher.

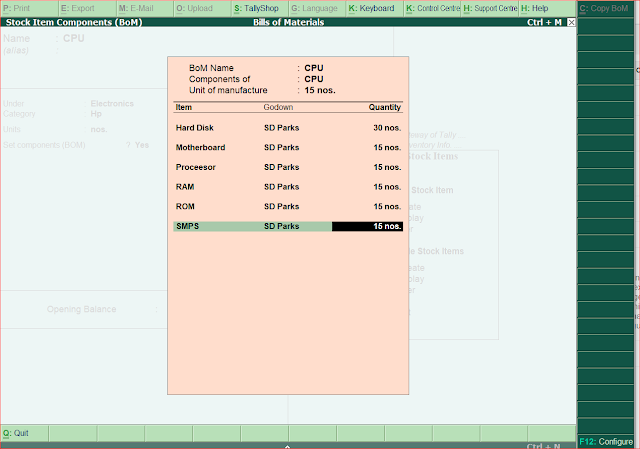

Step 7: Back again go to inventory info. Select stock item then create CPU (final product).

Enable BOM.

( Choose material that will be use for making final product)

Step 8: back select voucher type --> create:

Manufacturing journal under stock journal.

( Use for manufacturing option "yes".)

Step 9: Bank to gateway of telly --> inventory voucher then press alt+f7 for stock journal afterwards add relevant components and additional cost or expenses.

Step 10: Press f8 for sales voucher then pass entries.

Step 11: Check entries from display.

Let's understand with example and by using telly ERP 9:

Bills of material example:

ISD company purchase following material or components from xyz ltd for production of CPU units:

Additional cost including:

Labor charges 600.

The company sold CPU to a debtor after making the final product. Pass the necessary entries.

Solution:

Step by step process for bills of material:

Step 1: create a new company or choose your existing company (alt + F3).

Step 2: Press F11 for company features select inventory features:

Enable stock categories.

Enable multiple go-down.

Step 3: Press f12 select acc/inventory info then.

Enable component list details (Bill of Materials)

|

| bills of materials |

Step 4: Back to gateway of telly --> accounts info. --> ledgers --> create:

Bank a/c. Under. Bank accounts

Labour charges. Under. Indirect expenses

Creditors. Under. Sundry creditors

Debtors. Under. Sundry debtors

Purchase a/c. Under. Purchase account

Sales a/c. Under. Sales account

Step 5: Back to gateway of telly --> inventory info. --> create:

Stock group. Electronics

Stock categories. Hp, intell etc.

Stock item RAM, ROM, SMPS, processor

Hard disk, mother board.

Units of measure. numbers.

Godown. SD parks.

Step 6: Then back to gateway choose inventory voucher then pass entries:

Press f9 for purchase voucher.

Press f5 for payment voucher.

Step 7: Back again go to inventory info. Select stock item then create CPU (final product).

Enable BOM.

( Choose material that will be use for making final product)

Step 8: back select voucher type --> create:

Manufacturing journal under stock journal.

( Use for manufacturing option "yes".)

Step 9: Bank to gateway of telly --> inventory voucher then press alt+f7 for stock journal afterwards add relevant components and additional cost or expenses.

Step 10: Press f8 for sales voucher then pass entries.

Step 11: Check entries from display.

Excellent data with lots of information. I have bookmarked this page for my future reference. Do share more updates.

ReplyDeleteTally Classes in Chennai

Tally Certification Course

Tally Training in Bangalore