Implementation of cost center in telly ERP 9.

What is cost center?

In telly ERP 9, cost center is used to allocate different cost and expenses incurred during in transaction. It helps to clarify different center where cost is exhausted. this feature allow to maintain proper record of multiple expense in one place.

What is cost categories

What is cost categories?

Let's understand this concept with the help of given below examples:

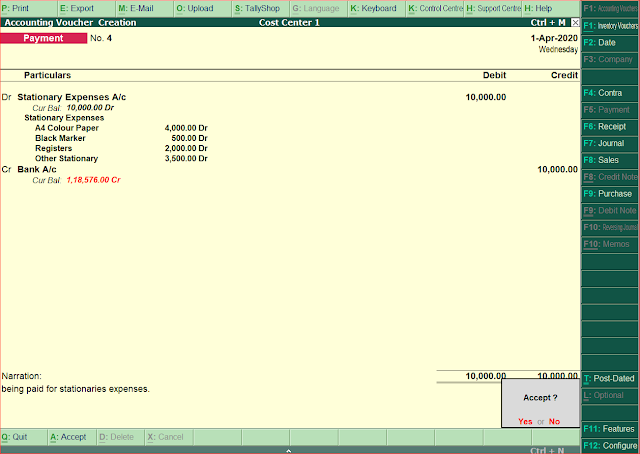

1. Paid on purchase of office stationary for 10000.

A4 colour paper. 4000

Black markers. 500

Registers. 2000

Other stationary. 3500

Pass the necessary entry for the payment of the above expenses.

Let's see how to create cost center and categories in telly ERP 9.

Step 1: Create a new company or choose your existing company by pressing alt +F3.

Step 2: Press F11 key then choose accounting features :

Enable maintain cost center option.

Enable cost categories option.

Step 3: Then back to gateway of telly select account info choose ledgers then create:

Stationary expenses under indirect expenses.

Bank a/c. Under. Bank accounts

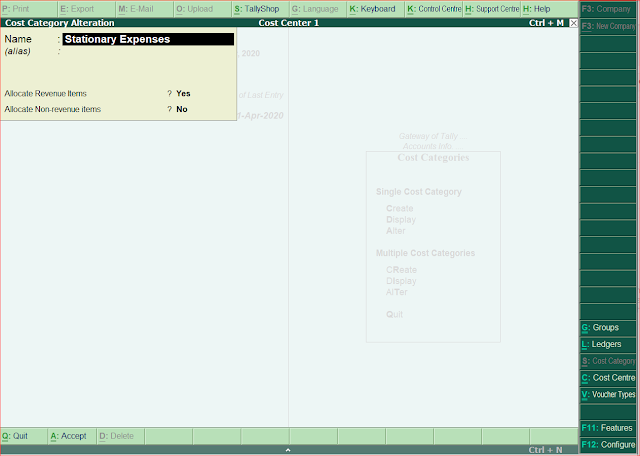

Step 4: Back to gateway of telly --> accounts info --> cost categories --> create.

Stationary expenses.

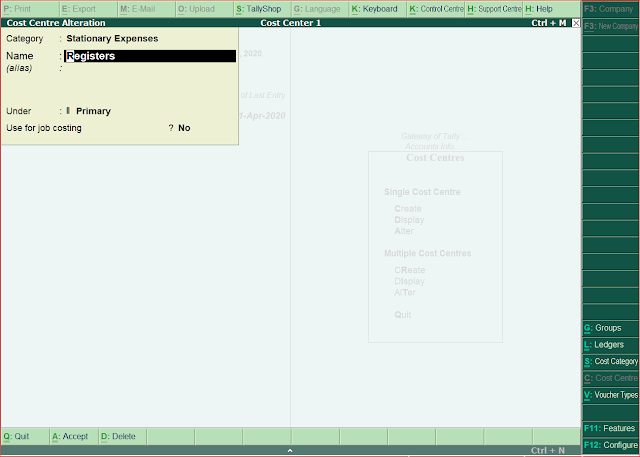

Step 5: Then back select cost centers choose stationary exp. and create given heads:

A4 colour paper.

Black markers.

Registers.

Other stationary.

Step 6: Back to gateway of telly--> choose Accounting voucher then press f5 for payment voucher.

(You can now specify the expense with particular center in which it has incurred.)

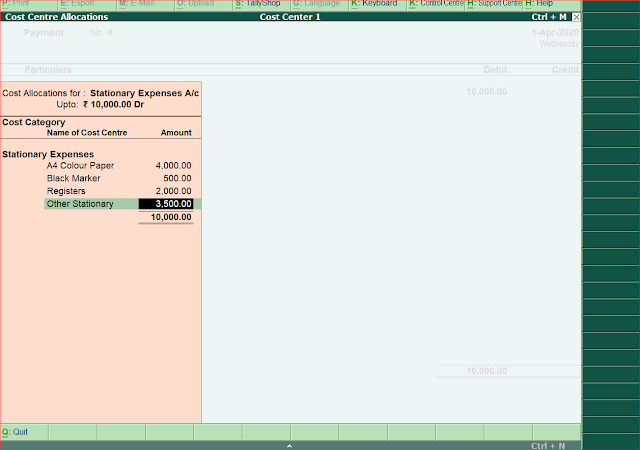

How to check cost center in telly ERP 9

Go to gateway of telly --> Display --> statement of accounts --> cost centers.

A4 colour paper. 4000

Black markers. 500

Registers. 2000

Other stationary. 3500

Pass the necessary entry for the payment of the above expenses.

Let's see how to create cost center and categories in telly ERP 9.

Step 1: Create a new company or choose your existing company by pressing alt +F3.

Step 2: Press F11 key then choose accounting features :

Enable maintain cost center option.

Enable cost categories option.

|

| cost center features |

Step 3: Then back to gateway of telly select account info choose ledgers then create:

Stationary expenses under indirect expenses.

Bank a/c. Under. Bank accounts

Step 4: Back to gateway of telly --> accounts info --> cost categories --> create.

Stationary expenses.

Step 5: Then back select cost centers choose stationary exp. and create given heads:

A4 colour paper.

Black markers.

Registers.

Other stationary.

Step 6: Back to gateway of telly--> choose Accounting voucher then press f5 for payment voucher.

(You can now specify the expense with particular center in which it has incurred.)

How to check cost center in telly ERP 9

Go to gateway of telly --> Display --> statement of accounts --> cost centers.

Comments

Post a Comment