Implementation of goods

and services tax

When talking

about GST big question arises “how GST applied”.

Goods and services tax is proposed system of indirect taxation in India. The concept

behind the introduction to new tax regime, merging most of the existing taxes

into a simple system of taxation.

Introduction of goods

and services tax in India

It was

introduced by 101 amendment in constitution act 2016 the chairman of the gst bill introduced by finance minister. It was held that gst would be

comprehensive indirect tax for manufactures self-consumption of goods and services.

Throughout India to replace the different tax levied by the central and state

government goods and service tax would be levied and collected at each stage of

sale or purchase of goods and services based on the input tax credit.

Impact goods and

services tax.

By following

this method it has allowed business to register themselves to take benefit of

the scheme and endeavor to government better collection of tax from the

customers.

The business

will be able to take benefit of claiming tax credit to the value of which they

have paid on gst purchases of goods and services are not distinguished from

one another the part will be attached till the goods and services reach to

consumers who will pay GST tax.

Administration of

indirect taxation in India

GST administration.

India being

a federal country where center and state have power to levy and collect taxes

through respective legislation. It was reason of a dual GST is implemented keeping

in mind federalism.

![]() Goods and services

tax

Goods and services

tax

CGST SGST

IGST

CGST – it is

stand for central goods and services tax levy and collected by central

government.

SGST – it stand

for state goods and services tax and levy and collected by state government.

IGST – it is

stand for integrated goods and services tax levy and collected by central government

and share with state amount tax collected.

Goods

& services tax implication in tally ERP 9

Here

is step

by step procedure to GST entries in tally.

step 1: create a new company or choose your exiting company.

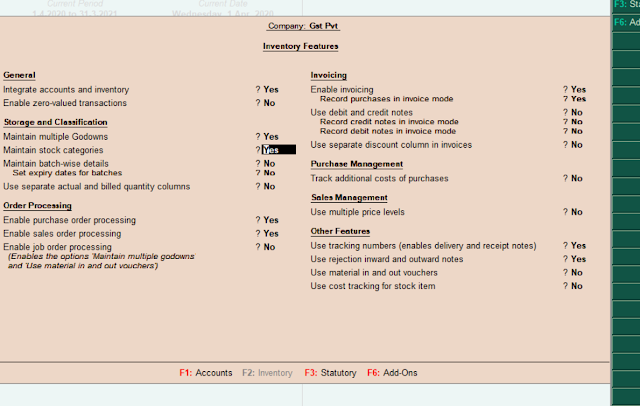

step 2: press f11 key select inventory feature enable: maintain godown yes

stock category yes

then press f3 for selecting statutory and taxation enable: Goods and services option yes

set\alter gst option yes

3 input CGST a/c under duties and taxes (gst option).

4. input SGST a/c under duties and taxes (gst option yes).

5. Input IGST a/c under duties and taxes (gst option yes).

6. Output CGST a/c under duties and taxes (gst option yes).

7. Output SGST a/c under duties and taxes (gst option yes).

8. Output IGST a/c under duties and taxes (gst option yes).

9. Debtors a/c(party's name) under sundry debtors.

10. Creditors a/c(party's name) under sundry creditors.

11. Bank a/c under bank accounts.

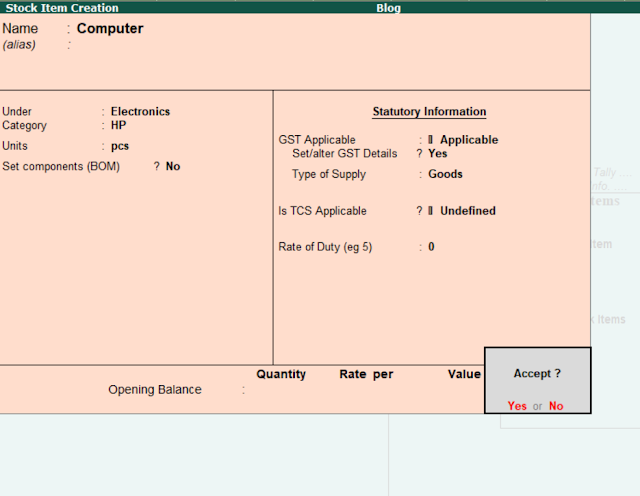

e.g. stock group - electronic

Stock category - HP.

Stock item - computer

Godown - Delhi.

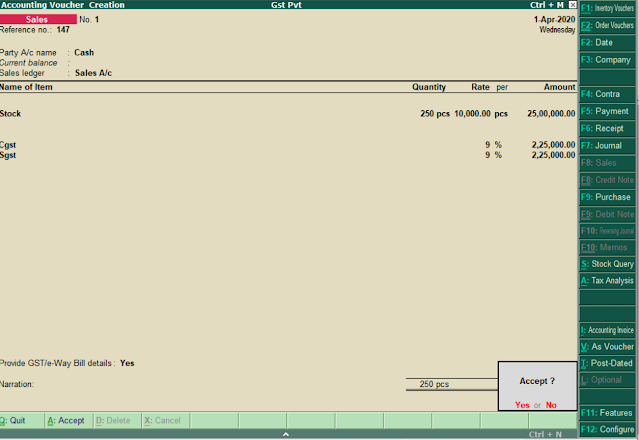

step 6: Back to gateway of tally select inventory voucher then press f9 for purchase voucher for passing purchase entries.

press f8 for sales voucher for passing sales entries.

press f5 for payment voucher.

press f6 for receipt voucher.

step 6: Go back to gateway of tally -->display-->statutory report -->GST analysis.

Comments

Post a Comment