What TDS means ?

TDS stand for "tax deducted at source" which means tax amount is deductible at source where income is generated. The collection of income is required by way of tax on income, dividends or assets sales. The tax payers are required to pay tax due before paying balance to the payee.

TDS (tax deducted at source)

TDS is part of direct tax collections by the government from every individual of the country. It collects taxes on prescribed rates from the source of income. TDS returns are filled in different forms prescribed in annual and quarterly returns. The income tax department has specified criteria for collection of TDS. It has a great importance while conducting tax audits. The tax changed on specified criteria helps to the government to generate higher rate of revenue from people of country.

Let us take an example of TDS

Assuming the nature of payment is commission and brokerage on which the specified rate is 10%.

XY Ltd makes a payment of Rs 60,000 towards commission and brokerage to Mr. ABC, then XY Ltd shall deduct a tax of Rs 6,000 and make a net payment of Rs 54,000 (50,000 deducted by Rs 6,000) to Mr. ABC. The amount of 6,000 deducted by XYZ Ltd will be directly deposited by XYZ Ltd to the credit of the government. The government will collect the amount for the same.

TDS in telly ERP 9

TDS in telly ERP 9 provides an essay to use and flexible interface for users . It is way of collecting income tax . It has to help us to handle different cases and to calculate the tax payable to the income tax department.

Telly ERP 9, can calculate the tax due to all parties / suppliers where TDS deduction is mandatory and competent enough to calculate TDS automatically and prints form 16A certificate, form 26Q, 27Q, 26, 27, 27A for quarterly/annual returns as per statutory requirements. We can view and able to print various TDS reports, challan and TDS outstanding statement.

Now we will understand the practical steps and TDS entry in telly ERP 9 with the help of above example:

step 1: Create a new company or select your existing company from company info.

step 2: Press f11 key for company features then choose statutory and taxation enable TDS option.

step 3: Then back to gateway of telly press f12 key select invoice/order entry enable TDS option. (if any)

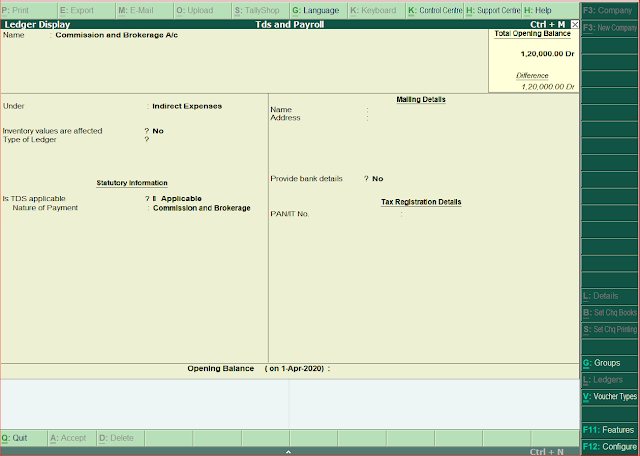

step 4: Back to gateway of telly -->account info -->ledgers -->create:

(1) bank a/c under bank accounts

(2) Mr. ABC under sundry creditors (TDS option yes)

(3) TDS on brokerage and commission under direct expenses (TDS option yes)

(4)commission and brokerage under indirect expenses (TDS option yes)

step 5: Go to gateway of telly --> accounting voucher then press f7 for journal voucher pass below entry:

(1) commission and brokerage a/c Dr. 60,000

To Mr. ABC 's a/c 54,000

To TDS on commission and brokerage 6,000

(10% of 60,000 for TDS collection)

Press f5 for payment voucher :

(2) Mr.ABC a/c Dr. 54000

To Bank a/c 54000

( being payment made to creditors)

(3) TDS on commission and brokerage Dr. 6000

To Bank a/c 6000

( being TDS collection deposited to govt.)

step 6: Then go back to gateway of telly --> Display --> statutory reports.

Comments

Post a Comment