Interest calculation

Interest is amount or rate which is charged on a principal amount borrowed by a person for a given period of time. The interest also known as the extra amount payable on the basis of installments.

The interest is usually payable on loans, bank loan, loan from creditors, interest on savings account etc. Interest calculation on loan is calculated by taking the principal amount taken and how long it will going to use. Then the rate of interest is decided.

The interest is usually payable on loans, bank loan, loan from creditors, interest on savings account etc. Interest calculation on loan is calculated by taking the principal amount taken and how long it will going to use. Then the rate of interest is decided.

Types of interest

We have generally two types of interest given below:

1. Simple interest: It is interest basically charge on principal amount borrowed. The amount of interest is set on the amount of loan taken.

2. Compound interest: It is a interest which calculate on both principal amount and also compounding interest which is to be paid on loan or amount taken.

5. interest on loan under indirect exp.

(enable interest calculation)

Step 4: Back then select voucher type choose alter then select Debit note.

Write "interest payable" in name of class.

(Enable "use class for interest calculation")

Step 5: Back to gateway of telly select inventory info then creat stock.

Stock group electronics.

Stock categories. Hp

Stock item. Laptop.

God own. Delhi.

Step 6: Back to gateway of telly select accounting voucher then pass entries.

step 7: Back to gateway of telly and now after 6 months we can pay to xyz ltd. the loan with interest due.

1. Press control+f8 for debit note then choose interest payable head.

2. Pass payment entry for loan with interest amount.

(note: for checking the interest amount you can simply go to display--> statement of accounts--> interest calculation.)

Interest calculation in telly ERP 9

In telly ERP 9, we can easily calculate interest on various situations such as interest calculation daily, interest calculation monthly and interest calculation annual basis. Telly provide automatic calculation of interest facilities to their users.

Interest calculation in Telly step by step.

Practical example.

1. ABC ltd purchase 100 pieces of laptop from xyz ltd. @ 25000 each from their shop. By taking into consideration that ABC ltd. paid a cheque only 500000 and asked to make loan. Xyz ltd accepts the amount and make loan for 6 months equal installments and charging interest @5% on that.

Pass the necessary entries in telly ERP 9.

Solution.

Total amount of purchase = 25,00,000

Less: being paid cheque = 5,00,000

Amount payable 20,00,000

Interest on loan(20,00,000×5/100×6/12)= 50,000

Monthly installment ( 50,000÷6) = 8,333

Interest calculation in telly

Step 1: create a new company ( alt+F3) or choose your existing company.

Step 2: Press F11 key for company and choose accounting features.

Enable interest calculation.

Enable debit note and credit note.

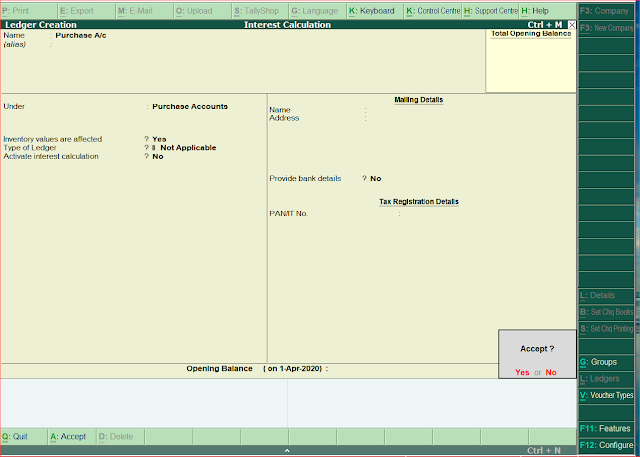

Step 3: Go to gateway of telly --> accounts info --> ledgers --> create.

1. Bank a/c under. Bank accounts

2. Purchase a/c. Under. Purchase account

3. Creditors ( xyz ltd) under. Sundry creditors

( Enable interest calculation)

4. Loan a/c under. Liability a/c

( Enable interest calculation)

5. interest on loan under indirect exp.

(enable interest calculation)

Step 4: Back then select voucher type choose alter then select Debit note.

Write "interest payable" in name of class.

(Enable "use class for interest calculation")

Step 5: Back to gateway of telly select inventory info then creat stock.

Stock group electronics.

Stock categories. Hp

Stock item. Laptop.

God own. Delhi.

Step 6: Back to gateway of telly select accounting voucher then pass entries.

1. purchase entry.

2. then pass payment entry. (note xyz made a loan of 2000000 of the remaining amount)

2. then pass payment entry. (note xyz made a loan of 2000000 of the remaining amount)

1. Press control+f8 for debit note then choose interest payable head.

2. Pass payment entry for loan with interest amount.

Comments

Post a Comment